FIVE STAR REVERSE FUNDING

- Is your social security paying you enough each month?

- Do you find yourself struggling or worrying about the future?

- Thinking about doing a reverse mortgage?

- Make home improvements and repairs!

- Enjoy your golden years!

Deal direct with owner and save

Discover the advantages of reverse mortgages and contact Russell, the trusted source.

What Is A Reverse Mortgage?

A reverse mortgage is a financial instrument that allows seniors to access the equity in their home. Seniors must be a minimum age 60, live in their own home, and have equity in it. The important distinction between a reverse mortgage and a conventional mortgage is that there are no principal or interest payments required on the home while the borrower occupies the property. In the case of two borrowers being on title, should one permanently leave the property due to a death or hospitalization, the other borrower continues to remain in the home. Repayment is only required if the borrower sells the home, or moves out of the property for more than 365 consecutive days.

In a conventional mortgage, the homeowner makes a monthly amortized payment to the lender; after each payment the equity increases by the amount of the principal included in the payment, and when the mortgage has been paid in full, the property is released from the mortgage. In a reverse mortgage, the home owner is under no obligation to make payments, but is free to do so with no pre-payment penalties. The line of credit portion operates like a revolving credit line, so a payment in reduction of a line of credit increases the available credit by the same amount. Interest that accrues is added to the mortgage balance. Additionally, with the line of credit option comes a feature known as the creditline growth rate, a particularly attractive feature not found in a traditional Home Equity Line of Credit. Funds left or returned to the line of credit are subject to the creditline growth rate which allows borrowers to gain on the unused funds. So, for example, if the borrower has been approved for $100,000 and uses $25,000 of that amount, they will accrue growth on the $75,000 balance. Assuming the interest rate is 6% the creditline will grow to $79,500—a gain of $4,500.

As with any mortgage, title to the property remains in the name of the homeowners, to be disposed of as they wish. As with a conventional mortgage, the title is encumbered by the security interest the bank has in the reverse mortgage. If a borrower does not make full monthly payments to cover the interest, that interest is capitalized (added to the principal). In the event that the interest accrues to a point that the amount owed is less than the home’s value the borrower may stay in the home and FHA will cover any loss to the lender or borrower.

A reverse mortgage lien is often recorded at a higher dollar amount than the amount of money actually disbursed at the loan closing. This recorded lien is at times misunderstood by some borrowers as being the payoff amount of the mortgage. The recorded lien works in similar fashion to a home equity line of credit where the lien represents the maximum lending limit, but the payoff is calculated based on actual disbursements plus interest owing.

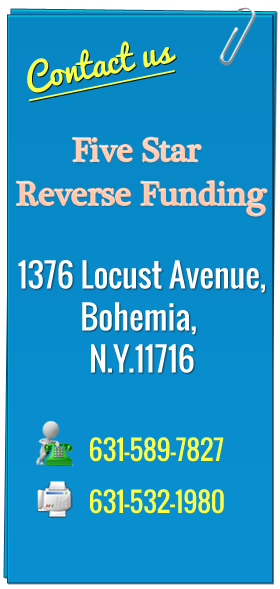

Russell Arceri

President / CEO

Reverse Mortgage Specialist

Hear what others have said about Russell

Learn how his reliability is exactly what you and your loved ones need when considering a reverse mortgage.

Common Misconceptions

If you are a homeowner and at least 60 years of age, here are some important things to consider.

Knowing the facts may help you better understand some of the most common misconceptions about reverse mortgages:

A reverse mortgage allows you to convert some of your home equity into accessible tax-free funds.

A reverse mortgage enables you to receive payments instead of making them.

You can receive those funds in a plan that fits your needs: Lump sum, monthly installments, a line of credit to draw from as needed or any combination of the three. And you can change your payment plan at any time throughout the life of the loan unless you take lump sum.

You can use your reverse mortgage proceeds any way you choose; including paying off your existing mortgage, supplementing monthly living expenses, paying for home repairs or renovations, covering medical costs or reducing credit card debt.

You continue to own and live in your home as long as all program requirements are met.

Program requirements include, but are not limited to, at least one homeowner living in the home as his or her primary residence, keeping taxes and insurance payments current and maintaining the home to FHA standards.

There are no income, credit score or employment requirements to qualify for a reverse mortgage.

If you have a remaining mortgage balance, you may still qualify for a reverse mortgage, but the remaining balance must be paid off with the reverse mortgage proceeds.

A reverse mortgage will not affect Social Security or Medicare benefits.

A reverse mortgage could even help you purchase a new home better suited to your needs.

Consult a tax advisor.

Reverse mortgage borrowers are required to obtain an eligibility certificate by receiving counseling from a HUD-approved agency. Family members and financial advisors are also strongly encouraged to participate in these informative sessions. Call for more detailed program information.

Loan proceeds are not considered income and will not affect Social Security or Medicare benefits. your reverse mortgage proceeds may affect your eligibility for other programs. Consult either a local program office or your attorney to determine how, or if, monthly reverse mortgage payments might affect your specific situation.